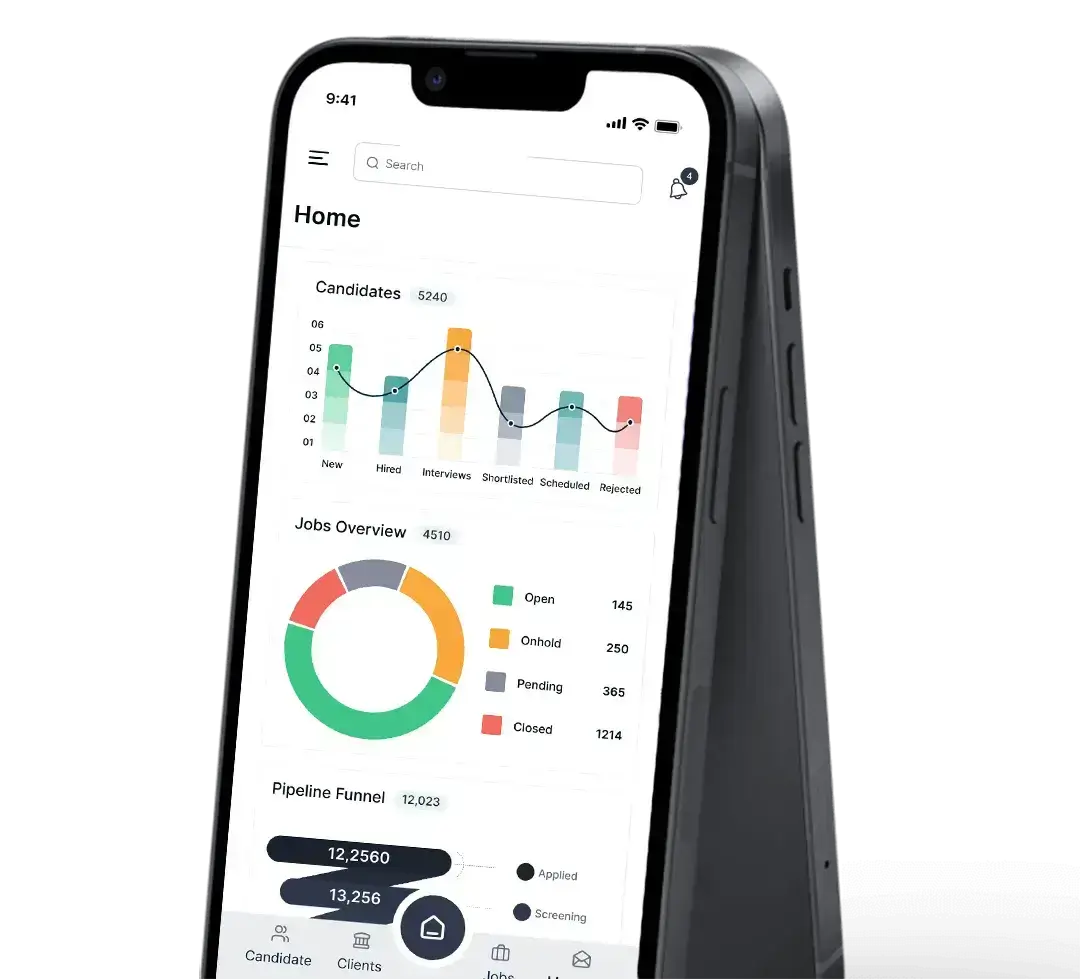

Payroll Management

Enwage’s Payroll Management module offers customized system setups and client-level configurations, streamlining payroll calculations, generating detailed reports, creating dynamic invoices, and ensuring compliance with tax regulations.

- Customize tax settings and payment methods

- Define roles and permissions for payroll administrators

- Configure pay periods, deductions, and benefits

- Set up automated tax calculations

- Specify payment frequencies

System Setup

Enwage’s System Setup empowers organizations to fine-tune their payroll processes with meticulous precision. Customize your payroll system, configure essential elements like tax settings and payment methods to ensure accuracy and compliance. Define roles and permissions for payroll administrators, guaranteeing secure access control. Establish pay periods, deductions, and benefits effortlessly, creating a tailored payroll environment. With automated tax calculations and the ability to specify payment frequencies, you have complete control over your payroll infrastructure, making it efficient and adaptable to your organization’s unique requirements.

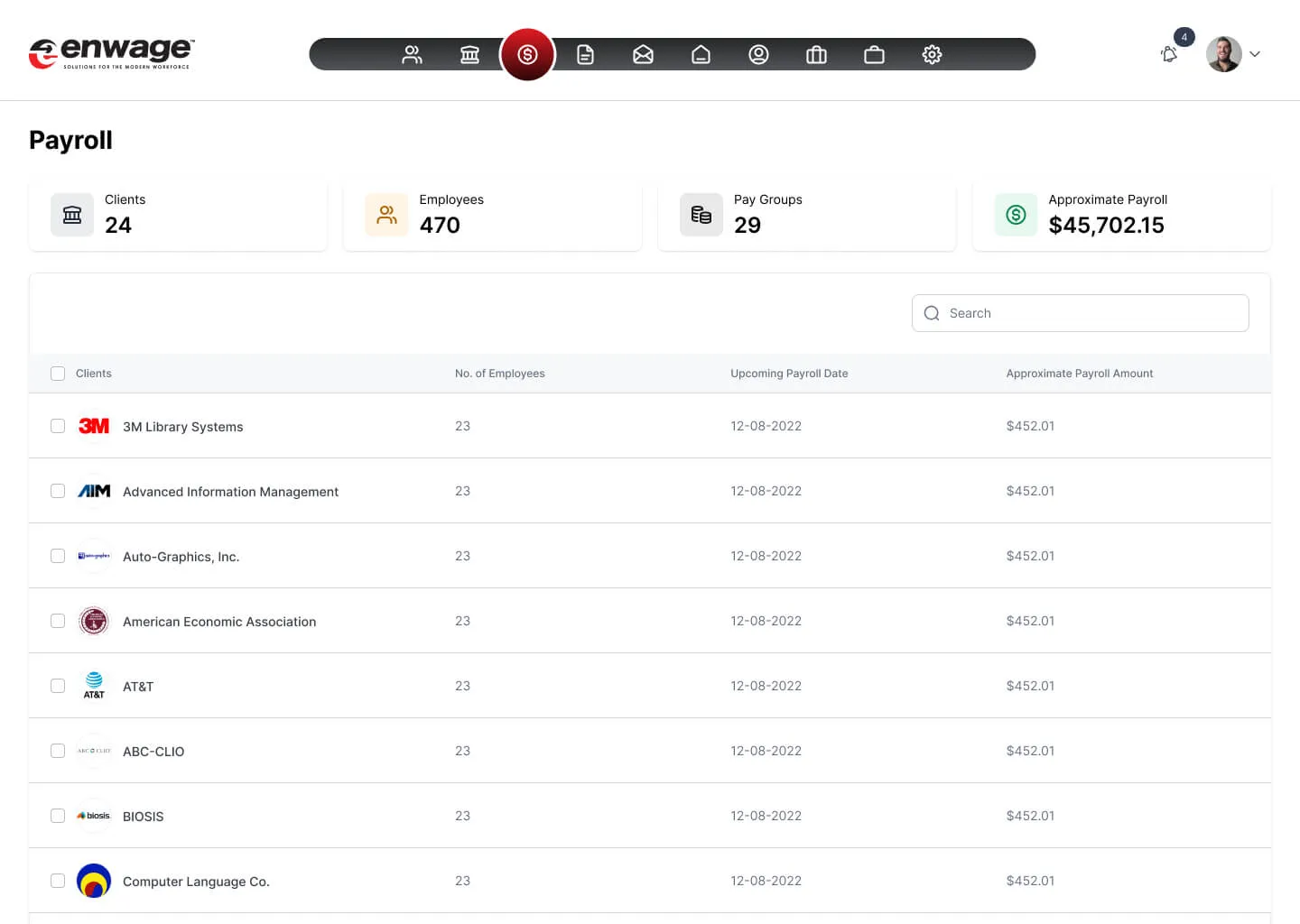

Client Level Configuration

Enwage's Client Level Configuration allows you to personalize payroll settings for individual clients or business units. Manage employee data, tax exemptions, and direct deposit information at the client level, ensuring flexibility and accuracy

- Tailor settings for specific clients or business units

- Set client-specific deductions, bonuses, and benefits

- Manage employee tax exemptions and direct deposit information

- Customize payroll reports per client

- Define client-specific pay cycles

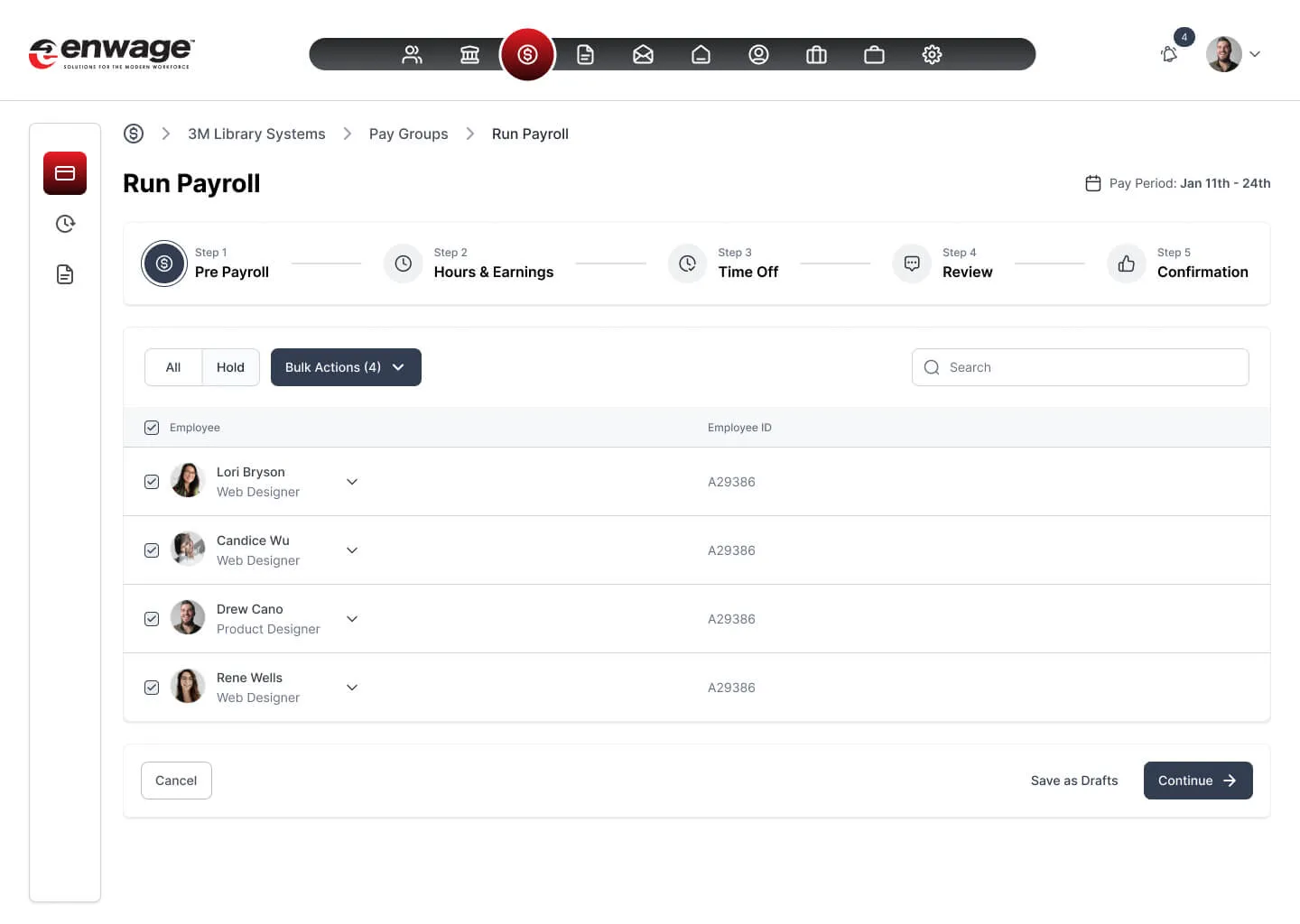

Payroll Processing

Automate payroll calculations, reduce errors, and save time with Enwage’s Payroll Processing feature. Generate detailed payroll reports, including pay slips and tax statements, to ensure compliance with tax regulations and wage laws.

- Automate precise payroll calculations.

- Generate comprehensive payroll reports.

- Ensure compliance with tax regulations.

- Automate direct deposit transactions.

- Calculate reimbursements accurately.

Reporting

Access in-depth payroll reports with Enwage’s Reporting functionality for valuable financial insights. Monitor payroll expenses, tax liabilities, and deductions. Generate year-end reports and summaries for compliance and analysis.

- Access detailed payroll reports.

- Monitor payroll expenses and deductions.

- Generate year-end reports for compliance.

- View historical payroll data.

- Analyze payroll trends.

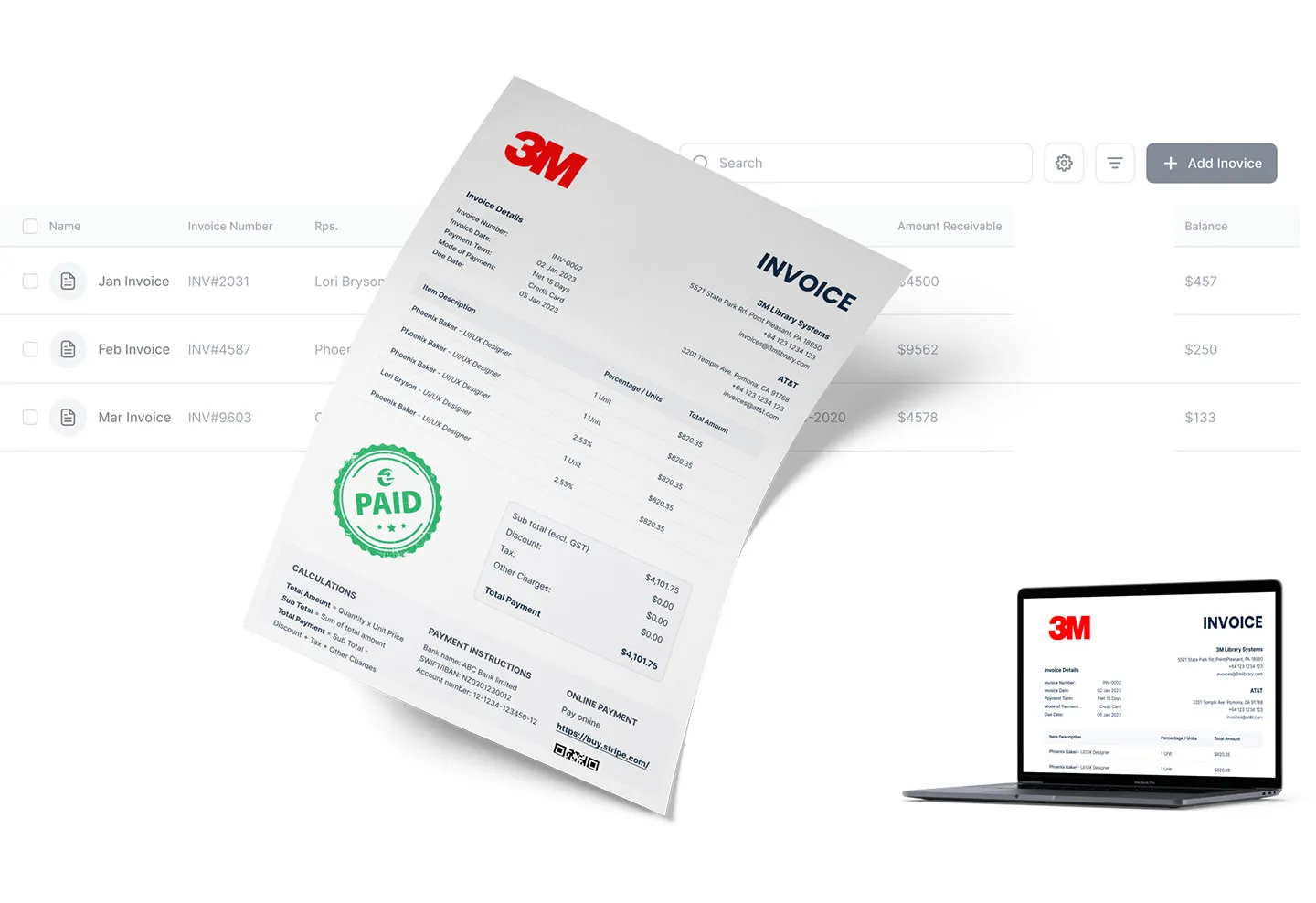

Dynamic Invoices

Create dynamic, customizable invoices based on payroll data with Enwage’s Dynamic Invoices feature. Automatically calculate service charges, taxes, and fees, streamlining billing processes and improving accuracy.

- Create dynamic, customizable invoices.

- Automate service charge and tax calculations.

- Streamline billing processes for clients.

- Generate invoices based on employee hours.

- Customize invoice templates..